Table of Contents

Airbnb has become a major player in the world of travel lodging while challenging the traditional hotel industry. Some people think Airbnb should follow the same rules as hotels, including paying similar taxes.

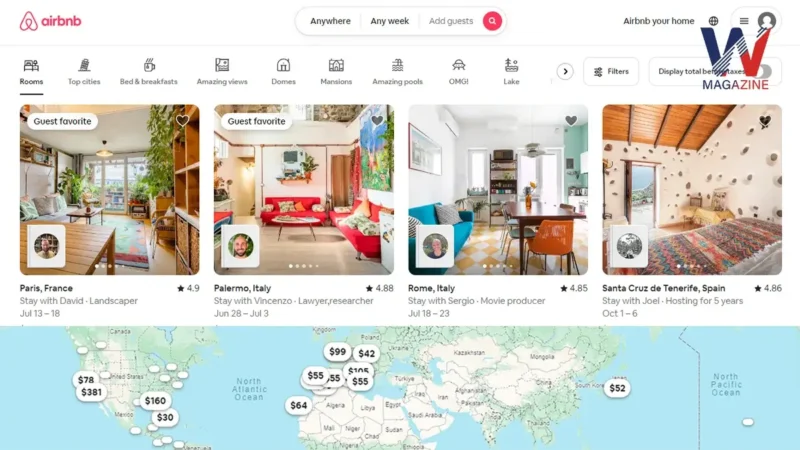

Airbnb’s main role is to connect hosts who want to rent out their homes for short periods to guests looking for a place to stay. While some big hotel brands like Hilton argue that they focus more on overall hospitality and see Airbnb more as just providing lodging, the lines between the two are blurring.

With the rise of the internet and new choices like Airbnb, it’s commonly thought that hotels might be losing out. However, looking at things like pricing who typically uses Airbnb and other factors helps highlight the key differences between staying at a hotel and choosing an Airbnb.

Key Takeaways

- Regulation & Taxes: Hotel groups and some state authorities are pushing to apply hotel-like taxes and regulations on Airbnb.

- Market Value: As of January 2022, Airbnb’s market value is over $109 billion, which is higher than many traditional hotel chains.

- Impact on Lower-End Hotels: Airbnb doesn’t sell products directly to consumers but has still managed to cut into the earnings of budget hotel groups.

- Disruption in the Luxury Segment: Similar to how Uber transformed the taxi industry, Airbnb is shaking up the revenue models of upscale hotels through the sharing economy’s rapid growth.

Overview of Airbnb

- Growth & Challenges: Since starting in 2008, Airbnb growth has been impressive, reaching revenues of $3.4 billion in 2020. However, the COVID-19 pandemic greatly affected its business, causing a 29% drop in revenues from 2019 and an 8% drop from 2018 due to restricted travel.

- Business Model: Airbnb operates as a marketplace where hosts and guests can exchange housing for money. Both parties can use reviews and social media links to build trust within the platform. This system of verifying trustworthiness through online reviews is also used by other platforms like Yelp although it’s not always directly available on hotel websites.

- Pricing Structure: Airbnb allows hosts to set their own prices based on the length of stay, whether it’s nightly, weekly or for longer periods. Prices can include charges for cleaning, weekend stays, and extra guests. Like hotels, prices may increase during weekends, holidays or in high-demand locations like major cities or tourist spots. Unlike hotels, Airbnb often includes cleaning fees in the pricing as hotels typically have their own cleaning staff.

- Regulatory Challenges: Airbnb has managed to avoid many of the taxes and regulations that hotels face but this can also lead to legal issues for hosts. In some states, laws restrict subletting for periods shorter than 30 days unless the primary resident is also present. Additionally, if a guest stays for over 30 days, they may gain tenant rights under local squatter laws.

Hotels Vs. Airbnb: Pricing & Offerings

- Location & Pricing: In big cities where living costs are high, both hotels and Airbnb hosts need to include the cost of prime locations in their pricing. Major hotel chains have set pricing strategies that respond to market demand, whereas Airbnb hosts can set prices based on what they feel is right.

- Accommodation Features: Typically, a standard hotel room provides a bed, bathroom and closet, with comfort levels varying. On the other hand, an average Airbnb apartment might offer similar amenities plus a kitchen and more living space, making it a more practical option for families/groups.

Focus on Luxury Market: Recently, Airbnb has ventured into the luxury market with the launch of Airbnb Luxe, directly competing with high-end hotels. Initially, Airbnb did not challenge this segment of the hotel market but now, it’s starting to offer a broader range of options, closing the gap between what hotels and Airbnbs can offer.

Focus on Luxury Market: Recently, Airbnb has ventured into the luxury market with the launch of Airbnb Luxe, directly competing with high-end hotels. Initially, Airbnb did not challenge this segment of the hotel market but now, it’s starting to offer a broader range of options, closing the gap between what hotels and Airbnbs can offer.

“In many circumstances, prospective customers discover that Airbnb is a more affordable alternative to many hotels.”

Key Differences in Taxes & Regulations

- Taxes & Regulations: Hotels, including various forms such as motels, inns and apartment hotels, must adhere to strict tax rules in places like New York. These rules include collecting sales tax on room charges and additional specific fees, like a daily hotel unit fee of $1.50 and other occupancy taxes in New York City.

- Airbnb’s Tax Situation: In contrast, Airbnb has not consistently been subject to the same occupancy and local sales tax laws. This has been a significant issue between Airbnb and local governments.

- Value-Added Tax (VAT): Both hotels and Airbnb include a VAT in their service fees, which is common in the European Union for accommodations. However, the application of VAT depends on local tax laws, so it’s not charged to every guest universally.

| Feature | Hotels | Airbnb |

| Pricing | Fixed pricing based on market demand. | Hosts set their own prices. |

| Accommodations | Standard rooms with basic amenities. | Variety, from rooms to entire homes. |

| Space | Generally limited to room and bathroom. | Often includes kitchen and living areas. |

| Regulations and Taxes | Subject to strict tax and regulatory rules. | Less consistently regulated for taxes. |

| Luxury Options | Standard luxury offerings. | Expanded into luxury with Airbnb Luxe. |

| Tax Compliance | Must collect sales taxes and occupancy fees. | Varies, sometimes includes VAT. |

This Wordle Magazine format provides a quick snapshot of how hotels and Airbnb differ in several key areas, which could help you decide which is more suitable for your needs or understand their business models better.

Frequently Asked Question

What is Airbnb?

Airbnb is a service that lets people rent out their properties or spare rooms to guests.

What does Airbnb stand for?

Airbnb stands for “Air Bed and Breakfast,” which refers to the concept of renting out air mattresses or spare rooms in a person’s home, similar to a bed-and-breakfast.

What really took down Airbnb?

Airbnb hasn’t been taken down, it continues to operate. However, it faced significant challenges during the COVID-19 pandemic due to travel restrictions.

How to start an Airbnb?

To start renting out your space on Airbnb, you need to create a listing on their website, set your price and prepare your space to welcome guests.

How much does Airbnb take?

Airbnb charges hosts a service fee, typically around 3% of the booking total, to cover the costs of running the platform.

How to become an Airbnb host?

To become an Airbnb host, sign up on their website, list your space, describe what you offer, set your price and follow the guidelines provided by Airbnb to attract guests.

Why is Airbnb illegal in Singapore?

In Singapore, laws around renting homes are strict. For example, public flats managed by the Housing Development Board have a rule that you must rent for at least six months and can’t rent to tourists. Private properties also need to be rented for a minimum of three months. Airbnb usually offers shorter stays, which doesn’t fit these rules, making it illegal for such short-term rentals.

Is Airbnb cheaper than Hotels?

Airbnb’s cost compared to hotels can vary. Often, Airbnb might be more affordable because it doesn’t have the same big costs that hotels do, like maintaining the property on a large scale. However, depending on the Airbnb and the hotel you’re looking at, it could also be more expensive.

Is Airbnb safe?

Generally, yes, Airbnb is considered safe. It has a thorough system to check the identities of hosts before they can list their spaces. Also, you can read lots of reviews from past guests that give you a better idea of what to expect from the host and the accommodation.