Table of Contents

- What is High Risk Merchant Account in Credit Card Processing?

- What Industries are Considered High-Risk?

- What Defines a Business or Industry as High Risk?

- Pros & Cons of High-Risk Merchant Accounts

- Which are the Top High-Risk Credit Card Processing Organizations?

- What is Credit Card Processing?

- FAQs

- How Long does a Credit Card Payment take to Process?

- How to Get into the Credit Card Processing Business?

- How does Credit Card Processing Work?

- How to Start a Credit Card Processing Company?

- What is Credit Card Processing?

- Are Credit Card Processing Fees Tax Deductible?

- How to Offset Credit Card Processing Fees?

- Are Credit Card Processing Fees Subject to Sales Tax?

- How Does Credit Card Processing Work?

- How Much is the Credit Card Processing Fees?

- Why do Credit Card Payments take so long to Process?

For most small businesses, accepting credit and debit cards is essential. However, if your business is in a high-risk industry, it can be harder to find a credit card processor or merchant account provider that will work with you. In this Wordle Magazine article, we’ll explain which industries are seen as high-risk, the advantages and disadvantages of having a high-risk merchant account and the best credit card processors for businesses in these industries.

What is High Risk Merchant Account in Credit Card Processing?

A high-risk merchant account is a type of bank account used by businesses that often have a lot of refunds and chargebacks. If a business is seen as risky, it might have to pay more for banking services and might be asked to keep a rolling reserve. This reserve is a safety net for the bank to cover any potential losses from too many refunds or chargebacks. On the other hand, businesses with excellent credit histories and low rates of chargebacks and refunds usually get standard merchant accounts.

What Industries are Considered High-Risk?

Some industries are considered high risk because they face strict regulations, frequent lawsuits or have unstable revenues. These industries often deal with big legal costs and a higher likelihood of failing. For example, businesses like weapons stores and tobacco shops are tightly controlled and often sued. Travel businesses, on the other hand, might not make steady money because they rely heavily on when and how much people spend, which can vary a lot.

“Within Traveling industry, Airbnb has become a major player in the world of lodging while challenging the traditional hotel industry.”

Here are some industries that are usually seen as high risk by banks and other lenders:

- Weapons manufacturers and stores.

- Tobacco, alcohol and cannabis sellers.

- Gambling and sports betting.

- Adult entertainment and content providers.

- Travel agencies and tour operators.

- Health supplement stores and pharmacies.

- Forex trading, payday lending and check cashing services.

- Debt collection agencies and auctioneers.

- Dating services.

- Subscription-based businesses.

“As Wordle Magazine explains, high-risk enterprises pay 4.5 percent in processing fees, while regular-risk businesses pay 2.9 percent.”

What Defines a Business or Industry as High Risk?

Companies use certain criteria to decide whether a business is high-risk or low-risk for credit card processing. Wordle Magazine has provided a table to help you understand the differences:

High-Risk Vs Low-Risk Criteria

| Category | High-Risk | Low-Risk |

| Monthly Transactions | $20,000 or more | Less than $20,000 |

| Average Transaction | $500 or more | Less than $500 |

| Industry | High-risk (e.g., forex, gambling, travel) | Low-risk (e.g., clothing, home goods, books) |

| Chargebacks | High chargeback and dispute rates | Low chargeback ratio (less than 0.9%) |

| Currencies | Accepts multiple currencies | Accepts only one currency |

| Payment Options | Offers subscriptions | Only single transactions (no subscriptions) |

| Business Scope | International | Only in the United States |

Pros & Cons of High-Risk Merchant Accounts

If you run a high-risk business, you’ll face some challenges, like higher costs but there are also some benefits. Here’s a simpler look at the pros and cons of having a high-risk merchant account:

Pros of High-Risk Merchant Accounts

- Broader Market Reach: Being a high-risk merchant lets you do business with customers in high-risk countries, potentially increasing your customer base more than low-risk merchants.

- Higher Profit Margins: You can offer a wider variety of products, which might lead to more sales and higher profits.

- Chargeback Flexibility: If you get too many chargebacks, a high-risk account might only freeze your transactions temporarily, whereas a low-risk merchant might get their account closed.

Cons of High-Risk Merchant Accounts

- Higher Costs: You’ll pay more in fees and rates because your business is seen as riskier.

- Regulatory Challenges: High-risk industries are often heavily regulated or closely watched. Changes in laws, like those affecting the sale of cannabis, could significantly impact your business.

- More Chargebacks: Industries like online gambling or adult entertainment might see more customers regretting their purchases and disputing charges.

- Increased Fraud Risk: High-value transactions can attract fraudsters using stolen credit card details, leading to sales being reversed when the fraud is discovered.

- Increased Stress: The uncertainties and potential for revenue disruptions in high-risk industries can be stressful for business owners.

| Category | Details |

| Market Reach | High-risk accounts can access international markets and high-risk countries, increasing potential customer base. |

| Profit Margins | Ability to sell a wider variety of products, potentially leading to higher profits. |

| Chargeback Flexibility | More lenient handling of chargebacks, with temporary transaction suspensions rather than account closures. |

| Higher Costs | Higher processing fees and rates due to greater perceived risks. |

| Regulatory Impact | High-risk industries face heavy regulation, which can affect operational stability. |

| Chargeback Frequency | Higher likelihood of chargebacks in certain industries like online gambling or adult entertainment. |

| Fraud Risk | Increased risk of fraud, especially in transactions involving high-value items. |

| Operational Stress | The uncertainties and potential revenue interruptions can add stress to business owners. |

While many businesses prefer to stay in the low-risk category, the potential profits in high-risk industries can make the extra challenges worthwhile.

“High-risk firms may pay higher credit card processing rates but they also benefit from increased profit margins, chargeback protection and the chance to locate clients in unpredictable countries.”

Which are the Top High-Risk Credit Card Processing Organizations?

Here’s a simpler breakdown of some of the best high-risk credit card processing providers:

Helcim

- Website: https://www.helcim.com/

- Rating: 4.7 out of 5.

- Overview: Helcim is known for its transparent pricing, showing all rates and fees clearly on its website. They use an interchange-plus pricing model, which is generally favorable for merchants. Their rates are comparatively lower and they offer a rate-lock guarantee, ensuring they won’t raise their prices during the lifetime of your account.

- Fees: Rather than multiple standard fees, Helcim charges a single monthly fee covering statements, customer service, PCI compliance and access to its all-in-one payment platform, Helcim Commerce. They don’t have early termination fees since services are provided on a month-to-month basis.

Square

- Website: https://squareup.com/

- Rating: 4.0 out of 5.

- Overview: Square charges a flat rate per transaction with no additional fees for setup, monthly service or PCI compliance. This makes it a cost-effective choice for small businesses with lower transaction volumes.

- Features: Square offers a top-rated mobile credit card processing app that includes point-of-sale software to help manage inventory, customer information and sales reporting. The app is free and you only pay for processing. It works on both iOS and Android devices and integrates with various business tools like payroll and email marketing.

Stax

- Website: https://staxpayments.com/

- Rating: 4.4 out of 5.

- Overview: Stax uses an interchange-plus pricing model without adding a markup percentage, just a per-transaction fee. This can be especially cost-effective for businesses that process a high volume of transactions.

- Fees: Stax charges a monthly membership fee which includes all services, making it simpler and sometimes cheaper for businesses processing over $7,000 monthly.

National Processing

- Website: https://nationalprocessing.com/

- Rating: 3.6 out of 5.

- Overview: Known for its low interchange-plus transaction rates, National Processing also promises to keep your rate fixed. They offer flexibility with no monthly minimums or long contracts.

- Hardware & Support: They don’t make their own hardware but are compatible with major third-party devices. Every merchant gets a dedicated account manager and access to 24/7 technical support and live chat.

Merchant One

- Website: https://www.merchantone.com/

- Rating: N/A

- Overview: Merchant One offers customized pricing to fit different business needs. Their interface is user-friendly, featuring a virtual terminal and comprehensive reporting tools.

- Fees & Hardware: The fees include a monthly charge, an annual fee and transaction fees. While Merchant One doesn’t produce its own hardware, it supports various payment methods including digital wallets and NFC payments. PCI compliance fees are also included in the monthly charge.

North American Bancard

- Website: https://www.northamericanbancard.com/

- Rating: N/A

- Overview: This provider offers quick setup and approval, often within a day, and provides free equipment to get started.

- Software & Discounts: Their Payments Hub software includes inventory management and detailed sales reporting. They also offer a cash discount program to encourage cash payments, helping businesses save on credit card processing fees.

These providers each have unique features and pricing structures, catering to different types of high-risk businesses.

What is Credit Card Processing?

Credit card processing is how businesses take payments using debit and credit cards. This process usually requires both hardware (like card readers) and software, working together with a credit card processing company’s network. These service providers typically charge a fee for each sale, which could be a percentage of the transaction plus a fixed fee per transaction.

For businesses that accept cards online or over the phone, where the physical card isn’t presented, the fees might be higher due to greater risk of fraud.

Risk is a big factor in credit card processing. Some businesses or whole industries are considered high-risk, meaning they might face higher fees and more strict conditions from credit card processors compared to other clients.

FAQs

How Long does a Credit Card Payment take to Process?

A credit card payment usually takes about 1 to 3 business days to process, depending on the card processor and the banks involved.

How to Get into the Credit Card Processing Business?

To get into the credit card processing business, you need to:

- Understand the industry, including regulations and technology.

- Partner with banks or existing processing networks to handle transactions.

- Obtain necessary licenses and compliance certifications.

- Develop or acquire the technology to process payments.

- Market your services to potential clients.

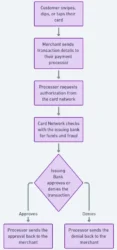

How does Credit Card Processing Work?

Credit card processing involves several steps:

- A customer presents their credit card for payment.

- The card details are sent to the merchant’s bank.

- The merchant’s bank requests authorization from the card network (like Visa or Mastercard).

- The card network confirms with the cardholder’s bank if the transaction can be approved.

- The transaction is approved or denied and the merchant is notified.

How to Start a Credit Card Processing Company?

Starting a credit card processing company involves:

- Gaining a deep understanding of the payment industry and technology.

- Securing partnerships with financial institutions.

- Complying with industry standards and obtaining necessary business certifications.

- Developing or purchasing the technology to process transactions.

- Building a client base by offering competitive rates and reliable service.

What is Credit Card Processing?

Credit card processing is the method by which businesses accept payments from customers using debit and credit cards. This process typically involves payment hardware and software that communicate with a processing company’s network to complete transactions.

Are Credit Card Processing Fees Tax Deductible?

Yes, credit card processing fees are generally tax deductible as a business expense. Businesses can deduct these fees when they file their taxes, as they are considered part of the cost of doing business.

How to Offset Credit Card Processing Fees?

To offset credit card processing fees, businesses can:

- Compare and choose a processor with lower fees.

- Pass a portion of the fees to customers through a surcharge or service fee.

- Offer discounts for customers who pay with cash.

- Increase product prices slightly to cover the fees.

Are Credit Card Processing Fees Subject to Sales Tax?

Credit card processing fees are not typically subject to sales tax because they are considered a service charge, not a tangible good. However, tax regulations can vary by location, so it’s wise to consult a local tax advisor.

How Does Credit Card Processing Work?

Credit card processing involves several key steps:

- Customer swipes, dips, or taps their card.

- Merchant sends transaction details to their payment processor.

- Processor requests authorization from the card network.

- Card Network checks with the issuing bank for funds and fraud.

- Issuing Bank approves or denies the transaction.

- Processor sends the approval or denial back to the merchant.

How Much is the Credit Card Processing Fees?

Credit card processing fees vary widely depending on the processor, the type of card used (credit, debit, rewards),\ and the merchant’s industry. Typically, fees range from about 1.5% to 3.5% per transaction.

Why do Credit Card Payments take so long to Process?

Credit card payments can take a few days to process due to the need for multiple approvals and checks for fraud and funds availability. Each step in the process involves communication between the merchant’s processor, the card network and the cardholder’s bank, which can take time.